(ARP) ASEAN Reinsurance Programme

Thailand Insurance Institute (TII), in collaboration with the ASEAN Insurance Council (AIC) and insurance institutes from 5 ASEAN countries—Indonesia, Malaysia, the Philippines, Singapore, and Thailand—is launching the ASEAN Reinsurance Programme (ARP).

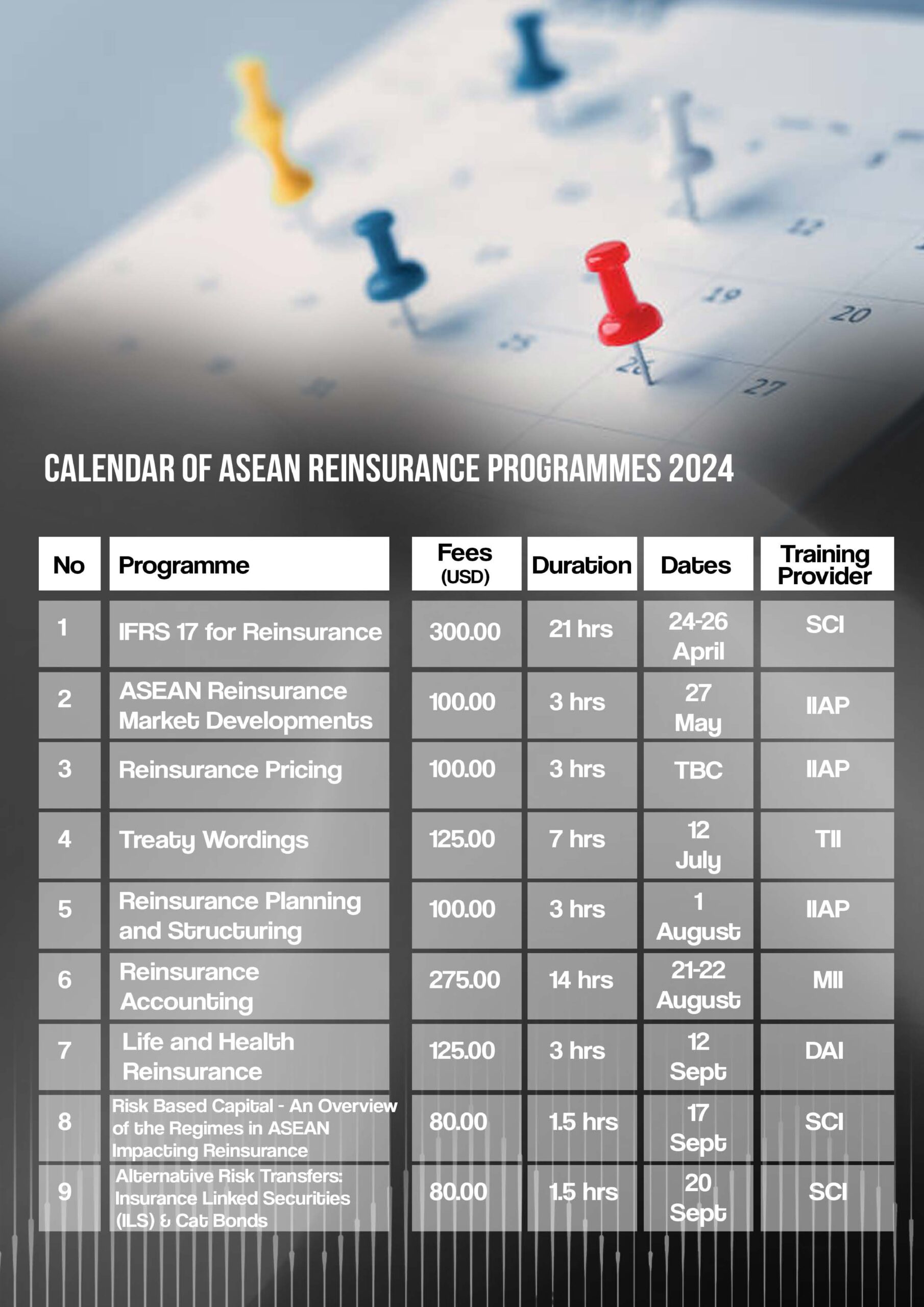

This programme compiles in-depth knowledge of reinsurance from all 5 countries, opening the door to the ASEAN regional market. Participants will receive a certificate from AIC upon completion. The course consists of 9 specialized modules, which can be selected based on individual interests.

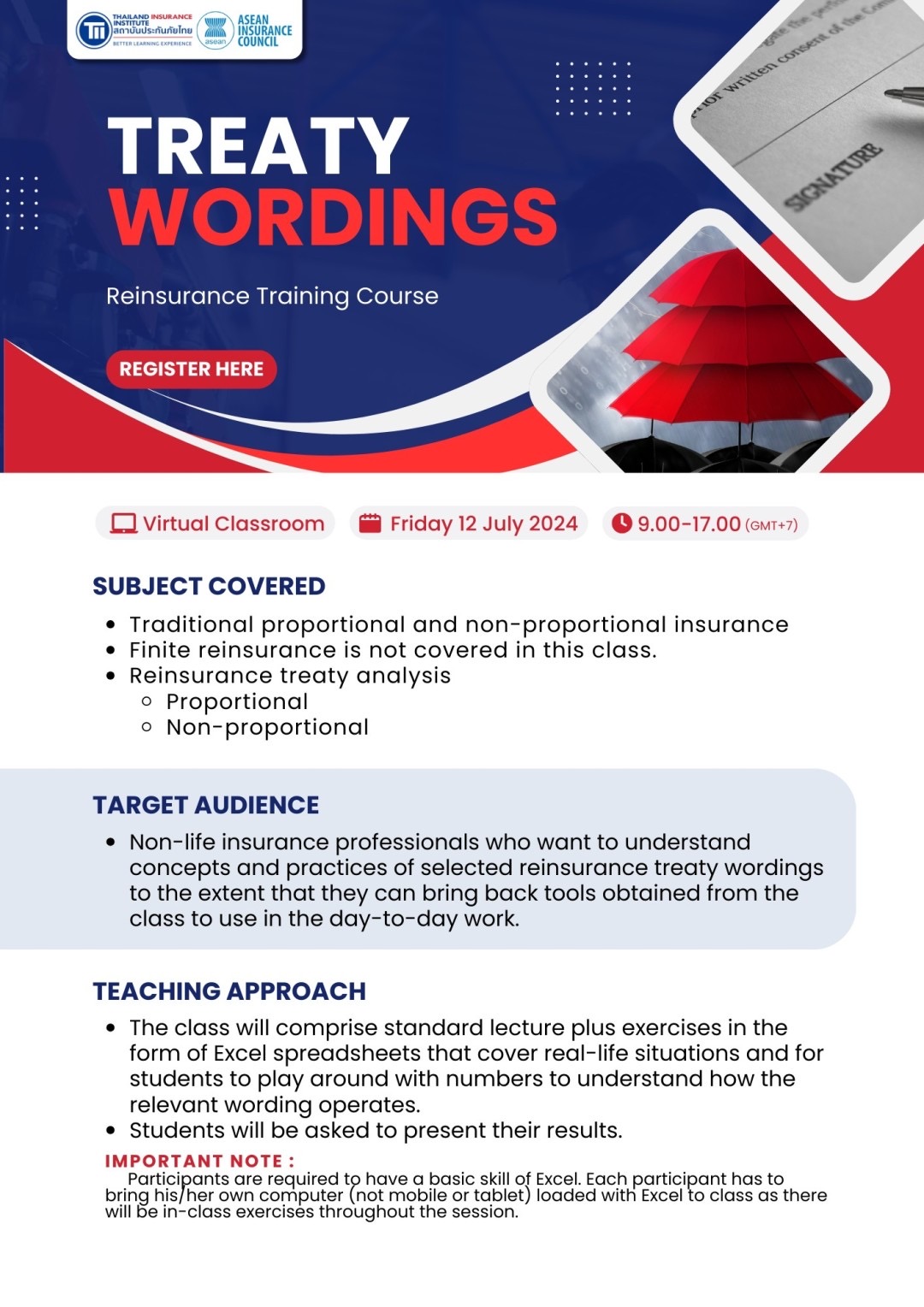

Thailand is hosting the “Treaty Wordings” module, which is held only once a year.

Training format

Class will be conducted online via Zoom, with lectures delivered in English by expert speakers from each participating country.

Subject Covered

- Traditional proportional and non-proportional insurance

- Finite reinsurance is not covered in this class.

- Reinsurance treaty analysis

- Proportional

- Non-proportional

Target Audience

- Non-life insurance professionals who want to understand concepts and practices of selected reinsurance treaty wordings to the extent that they can bring back tools obtained from the class to use in the day-to-day work.

Teaching Approach

- The class will comprise standard lecture plus exercises in the form of Excel spreadsheets that cover real-life situations and for students to play around with numbers to understand how the relevant wording operates.

- Students will be asked to present their results.

IMPORTANT NOTE :

Participants are required to have a basic skill of Excel. Each participant has to bring his/her own computer (not mobile or tablet) loaded with Excel to class as there will be in-class exercises throughout the session.

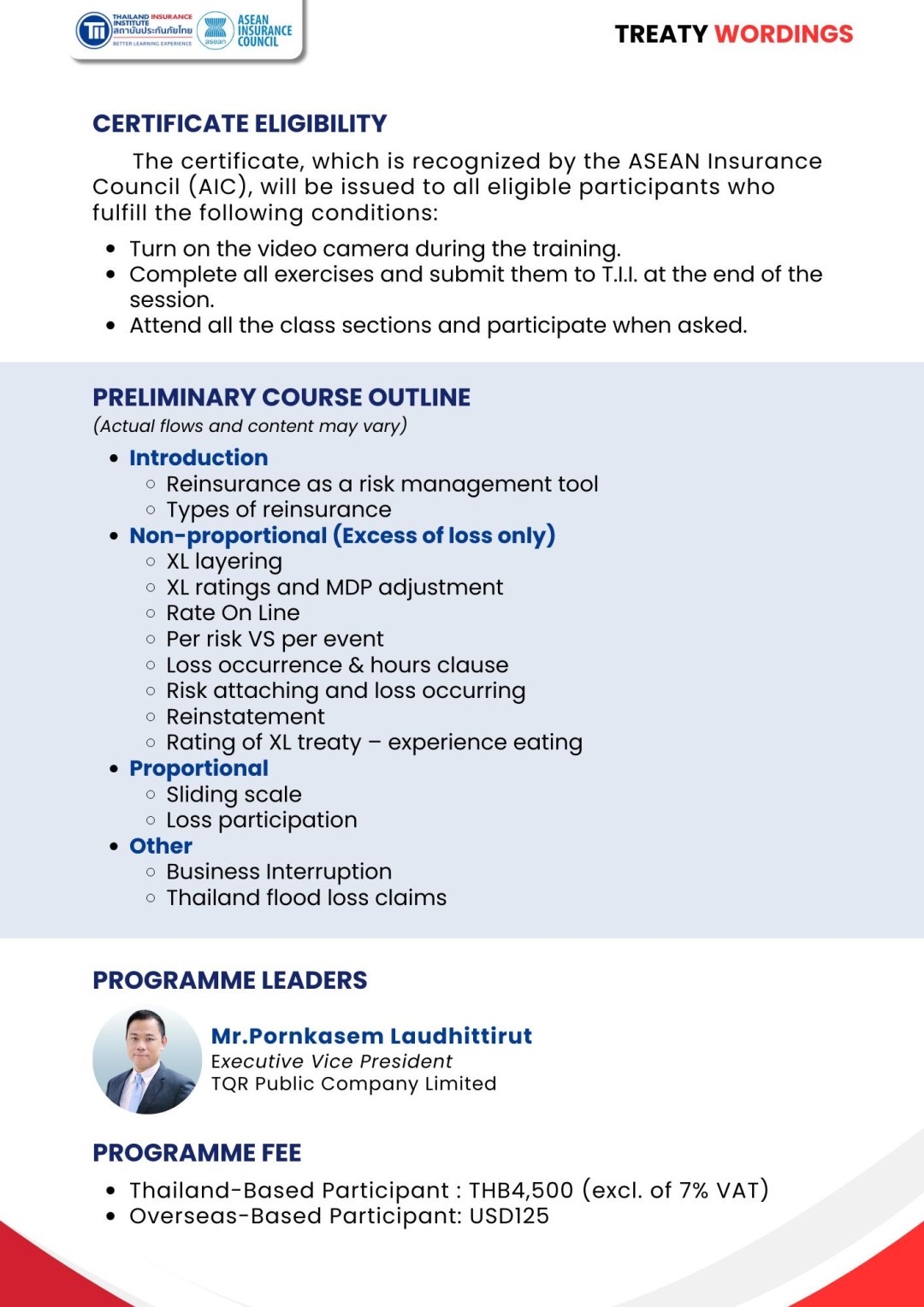

Certificate Eligibility

The certificate, which is recognized by the ASEAN Insurance Council (AIC), will be issued to all eligible participants who fulfill the following conditions:

- Turn on the video camera during the training.

- Complete all exercises and submit them to T.I.I. at the end of the session.

- Attend all the class sections and participate when asked.

Preliminary Course Outline

(Actual flows and content may vary)

- Introduction

- Reinsurance as a risk management tool

- Types of reinsurance

- Non-proportional (Excess of loss only)

- XL layering

- XL ratings and MDP adjustment

- Rate On Line

- Per risk VS per event

- Loss occurrence & hours clause

- Risk attaching and loss occurring

- Reinstatement

- Rating of XL treaty – experience eating

- Proportional

- Sliding scale

- Loss participation

- Other

- Business Interruption

- Thailand flood loss claims

Programme Leaders

Mr.Pornkasem Laudhittirut

Executive Vice President

TQR Public Company Limited

Programme Fee

- Thailand-Based Participant : THB4,500 (excl. of 7% VAT)

- Overseas-Based Participant: USD125