(APID) ASEAN Professional Insurance Diploma

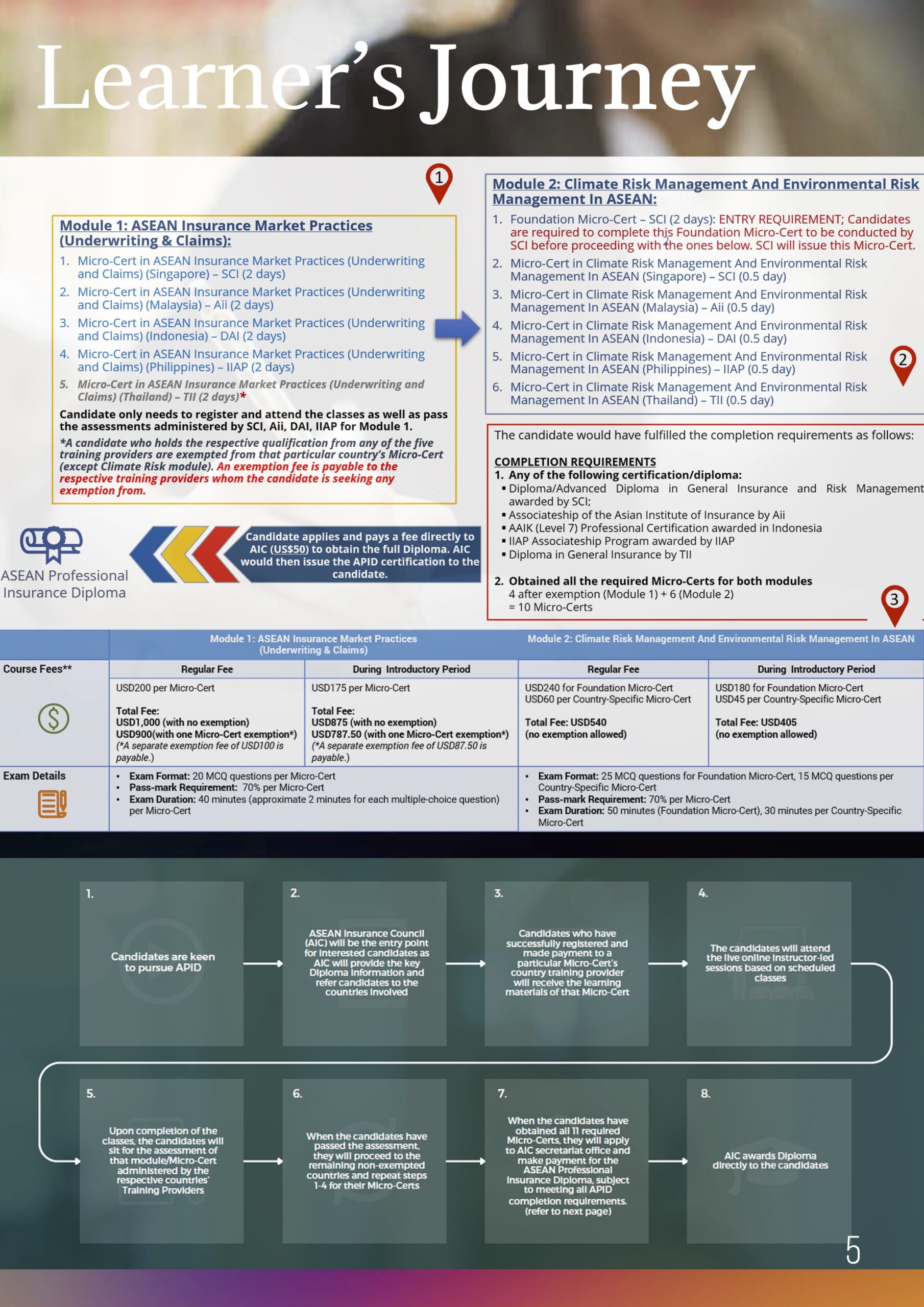

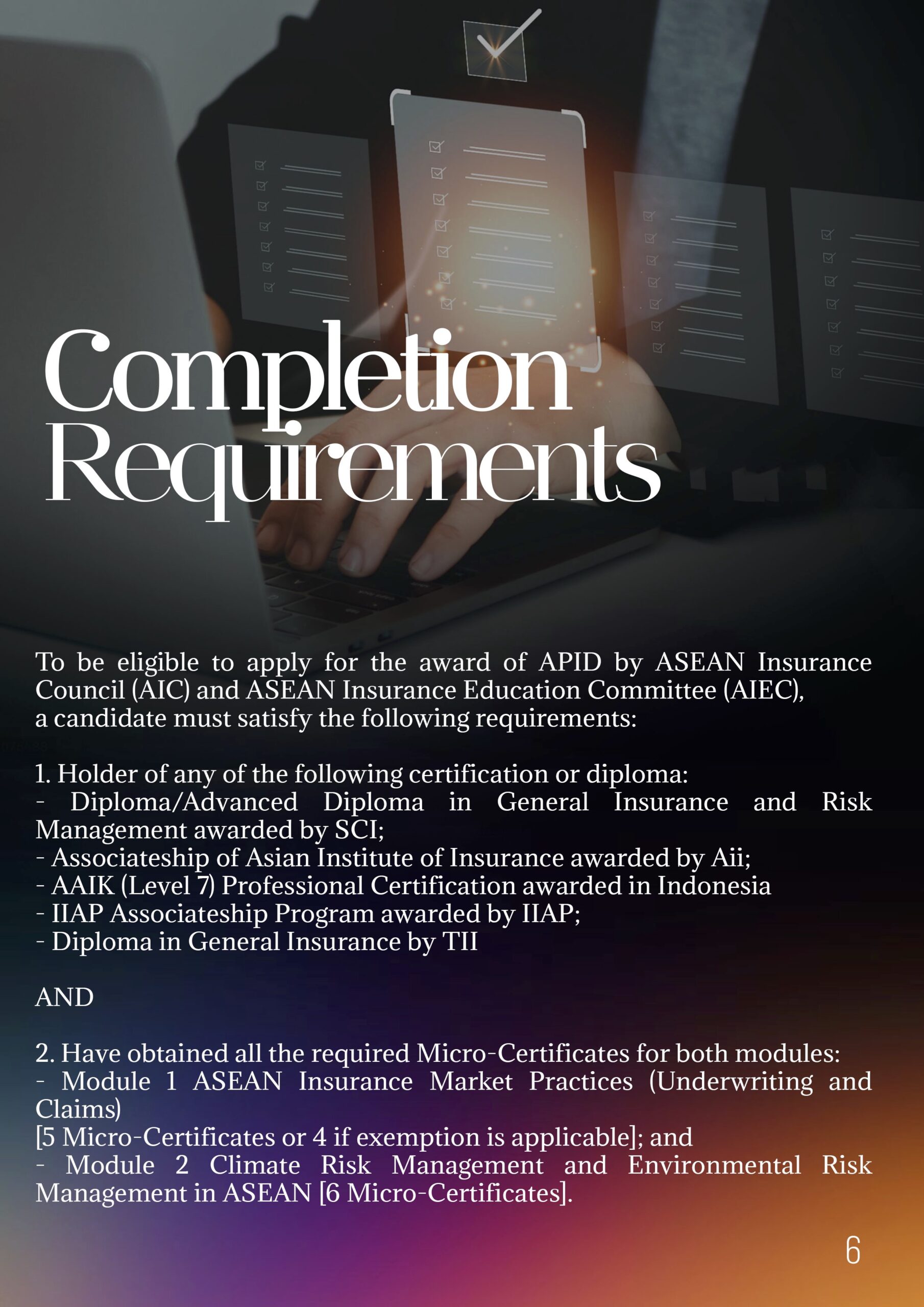

This professional certification is recognised by the ASEAN Insurance Council and has been jointly developed and marketed by five ASEAN Training and Academic Institutions. The certification comprises of five (5) micro-certifications from all five countries.

The Objective of APID

- Develop regional insurance talent with an overarching understanding of the ASEAN insurance industry to operate and lead in ASEAN-based organisations

- Enhance talent mobility within the ASEAN Insurance market as part of the ASEAN Economic Community’s (AEC) vision of ASEAN as a single market characterised by the free flow of capital, skills and resources

Duration

14.5 days in total for the entire APID (across the two modules)

Training format

Classes will be live online instructor-led sessions

Module | Duration (Days) | Assessment | Fee (USD) | Schedule | Registration |

|---|---|---|---|---|---|

MODULE 1: ASEAN INSURANCE MARKET PRACTICES (UNDERWRITING & CLAIMS) 10 Days in Total | |||||

Micro-Cert 1: Malaysia : Asian Institute of Insurance (Aii) | 2 | 20 MCQs

(40 minutes) | 200 | 24-25/03/25 | Closed |

Micro-Cert 2: Philippines : Insurance Institute for Asia and the Pacific (IIAP) | 2 | 20 MCQs

(40 minutes) | 200 | 23-24/7/25 | Coming Soon |

Micro-Cert 3: Singapore : Singapore College of Insurance (SCI) | 2 | 20 MCQs

(40 minutes) | 200 | 30-31/7/25 | Register |

Micro-Cert 4: Thailand : Thailand Insurance Institute (TII) | 2 | 20 MCQs

(40 minutes) | 200 | 14-15/8/25 | Register |

Micro-Cert 5: Indonesia : Dewan Asuransi Indonesia (DAI) | 2 | 20 MCQs

(40 minutes) | 200 | /7/24

| Coming Soon |

MODULE 2: CLIMATE RISK MANAGEMENT AND ENVIRONMENTAL RISK MANAGEMENT IN ASEAN 4.5 Days in Total | |||||

Micro-Cert 1: Singapore : Singapore College of Insurance (SCI) | 2 | 25 MCQs

(50 minutes) | 240 | 21-22/7/25 | Coming Soon |

Micro-Cert 2: Indonesia : Dewan Asuransi Indonesia (DAI) | 0.5 | 15 MCQs

(30 minutes) | 60 | 14/8/25 | Coming Soon |

Micro-Cert 3: Malaysia : Asian Institute of Insurance (Aii) | 0.5 | 15 MCQs

(30 minutes) | 60 | 20/8/25 | Coming Soon |

Micro-Cert 4: Philippines : Insurance Institute for Asia and the Pacific (IIAP) | 0.5 | 15 MCQs

(30 minutes) | 60 | 15/9/25 | Coming Soon |

Micro-Cert 5: Singapore : Singapore College of Insurance (SCI) | 0.5 | 15 MCQs

(30 minutes) | 60 | 25/9/25 | Coming Soon |

Micro-Cert 6: Thailand – Thailand Insurance Institute (TII) | 0.5 | 15 MCQs

(30 minutes) | 60 | 6/10/25 | Coming Soon |

MODULE 1: ASEAN Insurance Market Practices (Underwriting & Claim)

(Thailand)

This Certification is recognised by the ASEAN Insurance Council (AIC) in its award of the prestigious ASEAN Professional Insurance Diploma (APID).

Register time

LEARNING OUTCOMES

- Explain the general insurance market landscape in Thailand

- Analyse insurance product, service development and positioning in the Thailand insurance

markets - Examine the key influences of the regulatory and commercial environment on underwriting in

the Thailand insurance markets - Analyse the key aspects of underwriting policies and practices in Thailand

- Explain reinsurance practices in Thailand

- Evaluate the key aspects of claims handling pertaining to personal lines, material damage,

business interruption, third party liability and financial lines in Thailand. - Analyse claims reserving, complaint handling and fraudulent claims handling in the Thailand

insurance markets - Analyse the impact of technology and disruptors on underwriting and claims in Thailand

- Discuss the insurance laws, acts, regulations, codes and guidelines relevant to underwriting &

claims in Thailand

PROGRAMME SCHEDULE

Class Date | Exam Date | Examination Re-Take Date |

|---|---|---|

14-15 August 2025 | 18 August 2025

(40mins) | 21 August 2025

(40mins) |

EXAMINATION FORMAT

- 20 Multiple Choice Questions (MCQs)

- Pass Requirement: 70%

- Duration: 40 minutes

Programme Leaders

PRACH PATTRAKORNKUL

HEAD OF PRUDENTIAL

LAW DIVISION

SIVAKON KAEOCHUEN

SENIOR OFFICER

OFFICE OF INSURANCE COMMISSION (OIC)

VICHSUDA KANJANABUTARA

HEAD OF STRATEGY MANAGEMENT

OFFICE OF INSURANCE COMMISSION (OIC)

SITTIPORN INTUWONGES, Ph.D.

EXECUTIVE VICE PRESIDENT

TQR PUBLIC COMPANY LIMITED

JOMKWAN JANPHA

PARTNER

EY OFFICE LIMITED.

PICHET JIARAMANEETAWEESIN

DIRECTOR

ACTUARIAL BUSINESS SOLUTIONS CO., LTD.

MARK ADDERLEY

TECHNICAL DIRECTOR

ASIA AND HEAD OF CYBER ASIA / CRAWFORD & COMPANY

SUKRIT CHUNLAPHAN

CEO & FOUNDER

TECTONY CO., LTD.

Programme Fee

- Thailand-Based Participant : THB7,500 (excl. of 7% VAT)

- Overseas-Based Participant: USD200